Digital Core Reit

Digital Core REIT Well Supported by Cornerstone Investors. Digital Core REIT or DCR is a pure-play data centre REIT offering a total of 267 million units at US088 per unit to raise total gross proceeds of US977 million.

4 75 Yielding Digital Core Reit Is A Premium Reit Ipo My Thoughts Investment Moats

DPU in FY2023 is projected at 44 US.

. I was really hyped for this IPO but i guess i will be avoiding it after all. Thats a very strong performance. Real Estate Equity Real Estate Investment Trusts REITs. On that note Digital Core REITs preliminary prospectus has mentioned that its distributions will be made on a semi-annual basis.

Digital Core REIT is expected to have an aggregate leverage of 27 per cent as at the listing date -significantly lower than its peers - giving it a debt headroom of up to US596 million. Digital Core REIT Wins. Digital Core REIT offers an attractive distribution yield of 475 for Forecast Year 2022 and 500 for Project Year 2023 with a superior total return of 1001 with nearly 100 of Base Rental Income for Forecast Year 2022 and Projection Year 2023 derived from existing contractual leases. DC REIT has disclosed that their biggest customer has a AAA credit rating.

Is the manager of Digital. Digital Core REITs Product Highlight Sheet Page 4 of 11 PL and Balance Sheet. A REIT sponsored by a REIT. Basically a data centre REIT sponsored by Digital Realty a US listed REIT.

Share to Twitter Share to Facebook Share to Pinterest. In light of certain positives that has been pointed out by others this to me looks like a really bad deal. Posted by zzxbzz at 0625. Digital Realty as the Sponsor will be the largest unitholder of Digital Core REIT with a US390 million or approximately 39 ownership stake as at the listing date.

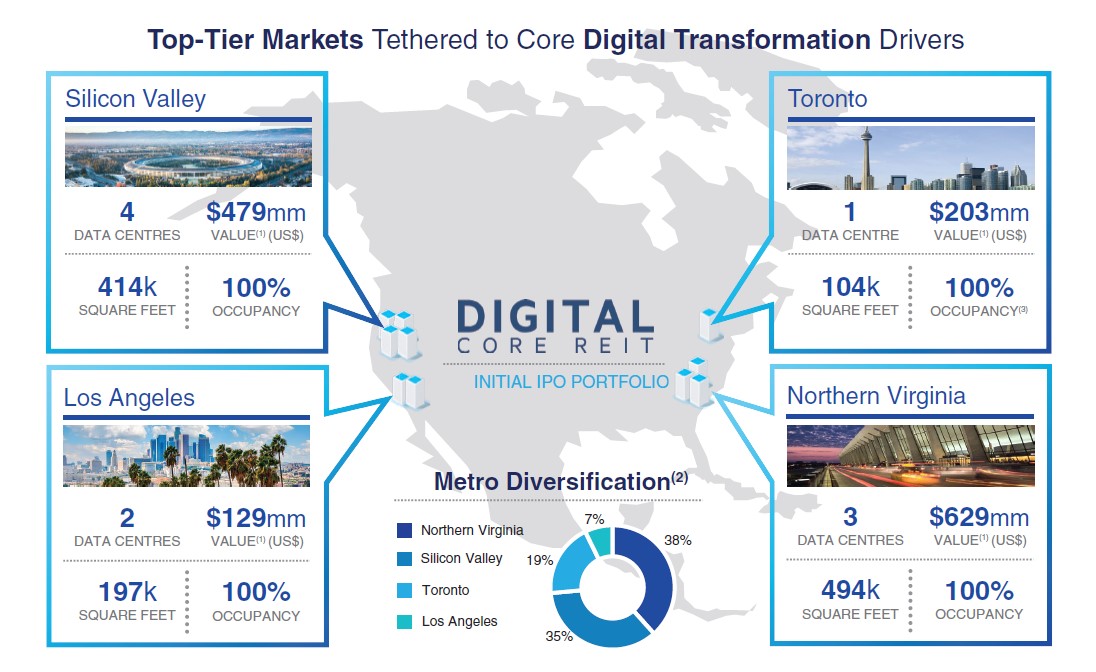

Digital Realty plans to co-invest in Digital Cores future assets by taking a 10 stake. According to a preliminary prospectus filed with the Monetary Authority of Singapore MAS on 22 November Digital Core REIT will have an initial portfolio of 10 data centres across North America valued at USD14 billion. Digital Realty NYSE. Other than the key risk mentioned in the article concentration risk in each asset Digital Core REIT seems to be a strong competitor against Keppel DC REIT in the data centre space.

Digital Core REIT is a Singapore REIT established with the principal investment strategy of investing directly or indirectly in a diversified portfolio of stabilised income-producing real estate assets located globally which are used primarily for data centre purposes as well as assets necessary to support the digital economy. As such having such a huge ROFR pipeline from. The appraised valuation of the assets was US1441b. The REIT will have an initial portfolio of 10 data centres located in both the US and Canada worth around US14 billion.

DIGITAL CORE REIT DCRUSI is scheduled to commence trading on 2021-12-06. All of the over-allotment units 53406000 units went into the placement tranche. This has some interesting implications on conflicts of interest that we. The IPO price is 88 US cents and the forecast distribution per unit DPU in FY2022 is 418 US cents giving a DPU yield of 475.

US 088 S 121 Offering Units. The REITs distribution policy is to distribute 100 of its annual distributable income from its listing date to the end of projection year 2023. This means room for taking on cheaper financing from bank borrowings to get a higher return for unit-holders. 267034 million Indicative Dividend Yield.

DLR released its Preliminary Prospectus announcing its intention to raise gross proceeds of 977m USD through the initial public offering IPO on the Singapore Exchange SGX of a newly created Singapore REIT S-REIT focused on data centers called Digital Core REITIncorporating drawn debt Digital Core REIT will have an enterprise value of 134bn USD upon. Public Offer Retail Tranche. Market ISIN Code. The offering price per unit will be at USD 088 per unit.

Digital Core Reit IPO intends to raise total gross proceeds of US 977 million. The Singapore public offer is offered at 121 per unit. Currently the highest fixed deposit rate that. As the sponsor they will own 39 interest in Digital Core REIT through Digital CR Singapore Holding LLC.

Being a highly defensive asset class it is hard to achieve meaningful and organic growth without acquisitions. Digital Core REIT Management Pte. Keppel DC Reit trades at a PE of 2236 while Digital Core Reit trades at an implied PE of 28 upon IPO. Digital Core REITs Distribution Details.

Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year. Despite the positive traits as. Applications for the Singapore public tranche of Digital Core REITs initial public offering IPO opens on 29 November at 9 pm. This will be the second pure-play data centre REIT to be listed on the Singapore Exchange after Keppel DC.

The REITs distribution policy is to distribute 100 of its annual distributable income from its listing date to the end of. The net property income for 2022 is US6686m which represents a property. The public offer Retail tranche was 13352000 Units. REITs are well-known to be able to dish out distributions to unitholders regularly.

Digital Core REIT DCR is raising around US600 million with cornerstone investors taking up 41478 million units or US365 million a placement of 25368 million units and 1335 million units available for retail investors. You read that right. There are currently only two US corporations with a AAA credit rating namely Microsoft and JohnsonJohnson of which only one of them is a software company. Lets summarize the IPO prospectus info as per the previous IPO posts.

The 2 nd biggest is likely to be Cyxtera as they have leased at. The REIT can decide whether they. SGX Mainboard SGXC50067435. The average capitalization rate was 425.

Digital Core REIT offers an attractive distribution yield of 475 for Year 2022 and 5 for Year 2023. Sector Industry Sub-Industry. The assets that make up the IPO portfolio are core to the Sponsors investment strategy and would continue to hold a 10 direct ownership stake in the Digital Core REIT properties. 0 0.

The IPO will close on 2 Dec 2021 at 12pm. On that note Digital Core REITs prospectus has mentioned that its distributions will be made on a semi-annual basis. Digital Core REITs Top 10 Tenants. The IPO has been priced in the local currency at SGD121 per unit based on the exchange rate of USD100 to SGD1375 as determined by Digital Core REITs manager.

Digital Core Reit is the only pure-play data centre Singapore Reit with 10 data centres located in key robust and. Known as the Digital Core REIT it will be the second data centre-focused REIT to list on the Singapore Exchange SGX after Keppel DC REIT made its debut in 2014. Points to exercise caution before diving into this IPO. Nov 29 2021 Digital Core REIT.

It was 196 times subscribed. REITs are well-known to be able to dish out distributions to unitholders regularly. Dear readers Digital Core Reit IPO is now open for subscription. Share Price as of.

Cornerstone investors or the larger institutional investors will take up 608 of the total IPO size. Digital Core REIT will be the exclusive S-REIT vehicle sponsored by Digital Realty the largest global provider of cloud- and carrier-neutral data centre colocation and interconnection solutions. Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year. Among the offering of 267034000 units 13352000 units are up for public subscription at US088 per unit or S121 per unit.

Digital Core REIT IPO Balloting Results Placement Tranche. Digital Core REITs Distribution Details. Less than a week after Daiwa House Logistics Trust was listed there is another REIT - Digital Core REIT DCR lodged its IPO prospectus. Digital Core REIT DC REIT is offering 267034 units at US 88 cents per unit for its IPO of which 13352m will be for the public and the rest via placement.

Its a pure play data centre S-REIT and sponsored by the largest global owner operator. Digital Core REITs financials. The placement tranche for Digital Core REIT IPO was 253682000 Units US223 million. Their top 10 customers are extremely high in quality.

Digital Core Reit Is Offering A 4 75 Distribution Yield Is This Sustainable The Smart Investor

Digital Realty Lists Digital Core Reit On Singapore Stock Exchange Nyse Dlr Seeking Alpha

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GYQ2QP4Z6NJ4JCY3ASJLYSGGVQ.png)

Digital Core Reit To Raise 600 Mln In Singapore S Biggest Ipo This Year Reuters

Comments

Post a Comment